For years Forex traders have been relying on Myfxbook to verify trading results of other traders and software sellers. However, there are so many ways to trick the system these days that this verification platform cannot be trusted all the time.

Watch my presentation on video or read the article below:

Traders are desperate for trade strategies that will propel them to instant riches. With the emergence of fake experts and malicious brokers out to make easier money from them, traders have no alternative but to seek ways of keeping these con men and women at bay. There are various ways of achieving this.

First, they may opt to learn the tricks to the trade, which is gruesome and time-consuming. Or they may look for experts in the investment field. However, they are hard to come by these days and for one expert broker or consultant, there are more than a hundred fraudsters.

The third option would be to use trading engines or tools that will prove the viability of trading strategies. One such engine is the Myfxbook, which is an analytical tool used by forex traders to prove or disprove the feasibility of trading methods.

While myfxbook is an indispensable tool towards eradication of poor trading strategies, there are individuals who have come up with creative and convincing ways of fabricating myfxbook account reports. With reports of ever-rising equity curves and a high percentage of profits, Forex scammers have been successful in selling fabricated strategies to both beginners and experienced traders.

Best ways to check if a myfxbook account is a fake:

- Check if the screenshot of the myfxbook portfolio is clickable or not;

- Check if the myfxbook account has not been updated for a long time;

- Check if the account was updated recently and when did the last trade ended;

- Check if the track record and trading privileges are verified;

- Check if the account has a lot of private information, such as balance, profit, equity, open trades, lots and history;

- Check if gain and absolute gains do not match (possible fake);

Recommended read: How to Identify Forex Scams in 5 Simple Steps

Is the Myfxbook screenshot on the website clickable?

Scammers know very well that people believe what they see. Therefore, using screenshots of altered myfxbook accounts, they easily win the trust of potential investors. This article is dedicated to revealing how myfxbook accounts are faked.

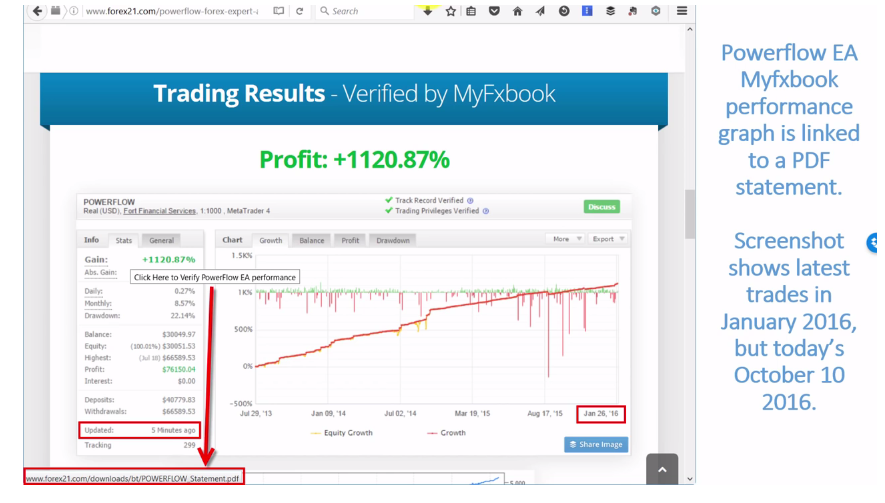

Let us examine the following screenshot:

This screenshot was taken from an “investment” website. After careful examination of the information displayed on the website, it became apparent that the site is owned by scammers. It is unfortunate that such websites appear on the first pages of google search results.

With so much garbage on the internet, getting a real investment website is like searching for a needle in a haystack. As it can be seen, the expert promises huge returns in few months- he made $170,136 from $1,800 to be exact and it only took six months to amass all that money. The investor further asserts that he withdrew $20,000 in profit to his personal bank account. There is also a list of profitable trades made over the period and an equity graph to visually display his gains.

While it may not be prudent to disqualify the information as false, there are signs that indicate that this information is fabricated.

For instance, the presence of extra text on the image from myfxbook account clearly indicates this. With tools like Photoshop, figures can be easily altered to produce the desired results. It should be noted that genuine websites have images or screenshots that are clickable or have links to the actual myfxbook account where the information can be easily obtained. Non-clickable screenshots with no links are nothing but fabricated images.

Recommended read: How To Know If a Forex Trading Signal Is a Scam

Make sure you are on Myfxbook’s domain?

The image below shows a real myfxbook account:

It can be clearly seen that this is a real myfxbook, evidenced by the presence of a link in the URL. The domain name should be exactly this way as highlighted by the red box. Subdomain names or slight changes to the domain name indicate fake websites and should be avoided at all cost.

The only place where any potential investor would get valuable insight and verified information is in the real myfxbook account website and nowhere else.

Can you verify that the list of trades is from legit myfxbook account?

Let us take a look at another example where the tricks become more sophisticated:

While the trading tools of this company project a profit margin of more than 1000%, there are red signs on the website that reveal the contrary. First of all, the company claims that all its trading results are verified by myfxbook. However, there is no single evidence to support the claim aside from the statement properly placed on top of the page. Furthermore, there is no activity on the website apart from a screenshot and a link at the bottom of the page. The link does not redirect you to the real myfxbook account, but rather connects to a pdf document on the company’s website.

The pdf document contains lists of trades allegedly from myfxbook account. However, it cannot be verified that indeed the list of trades are from myfxbook account. Even if the list was verified and obtained from myfxbook account, the last trades were done in January 2016. For nine months, there have been no trades.

So, the question is: why have they not been trading?

The only logical reason is that the company’s strategies do not work.

Was Myfxbook account updated recently and show signs of active trading?

Fabricated results are altered to showcase positive results while neglecting undesired outcomes and are, therefore, rarely up-to-date.

Consider the screenshot above. The website has its trading report and its subsequent link to the myfxbook account, which is a good sign.

However, upon clicking on the link it is noted that the trading closed six months ago- around February. But when you look at the history of the trades, they end in April, and the account was last updated on May, a month later after all trades were closed.

Another important issue to note is that all the open trades of the account are private. So, the last trade closed six months ago, the account was last updated four months ago and the open trades are not present for public scrutiny.

The only logical explanation is that most of the open trades were losing trades. Therefore, the trades were intentionally left out during verification process on myfxbook account, so that the trading strategy does not look bad. The open trades were then subsequently set to private.

Further scrutiny of the account shows that the equity is around 69%, which means that the equity fell down to 69% or the account lost approximately 31% of its money.

Unfortunately, most people concentrate on gains and the equity curve and overlook other factors such as equity, which are very crucial in the interpretation of trading reports.

To sum up, after this trading account turned bad the owner manipulated myfxbook account settings to still make it look good.

Recommended read: All About Repainting and Non-Repainting Indicators in Forex

Past performance does not guarantee future results

Now, all strategies on myfxbook are either uploaded backtests or live trading strategies.

Live trading can be done on a real account or a demo account.

Backtests, on the other hand, are created using a history of prices over a period of time. This article will not delve much into how backtests are created – for more information on backtests visit www.mt4backtest.com.

Backtests results should never be taken seriously because the process of creating them is rarely in the public knowledge and also because they can be easily fabricated compared to live trading.

The backtest feature on myfxbook, however, is a great feature as it enables users to know if strategies are viable based on past trading history.

Here is an example of an uploaded backtest on myfxbook:

On top is the strategy settings of the backtest, while below is the strategy report/results.

It should, therefore, be noted that any strategy result with its subsequent strategy settings on top of it on myfxbook is an uploaded backtest. Below the strategy settings, is a forward test link. Many people fail to click this link, which is an important identifier of a fake or a real backtest strategy.

There are instances where the backtest results look awesome. But upon clicking on the forward test link, we see the strategy fails to work or it had been stopped several months back.

Check if track record and trading privileges are verified

It is also paramount to properly check if track record and trading privileges of the strategy are verified.

If the account is personal and only used to check trading strategies at a personalized level, then the strategies do not need verification.

However, if the strategies are to be made public or used for commercial and consultative reasons, then they ought to be verified.

Without verification, the user may not be aware if the strategy is reliable or a hoax.

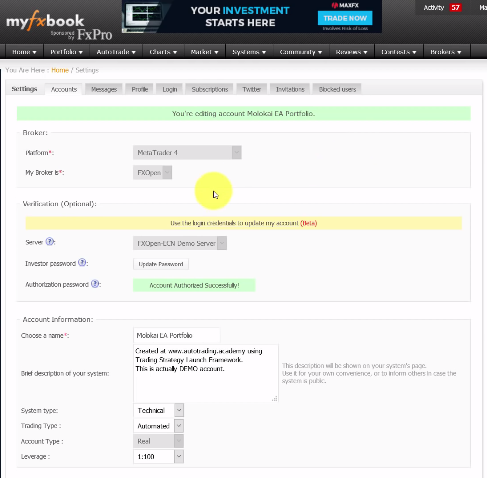

Consider the example below:

In this example, a trading strategy is uploaded to myfxbook account from FxOpen demo trading account. The account is purposeful set as a real account, even though it is a demo account. Myfxbook allows you to choose whether the strategy is from a real MT4 or demo MT4 account. It also allows you to verify both trading privileges and track record once you feed in investor password.

After verification myfxbook is able to detect whether the uploaded strategy is from a real MT4 account or a demo MT4 account and then sets it to the proper account type. So, the account was falsely set as a real account on purpose by myself to illustrate the problem.

However, after verification of the track record and trading privileges, the account does not change to a demo but remains a real account as shown above.

This is quite a big problem. It means that anyone can be easily fooled that an account is real when actually it is not.

This is how the uploaded strategy looks on myfxbook account. The trading privileges are verified and the account status is real (which is wrong):

However, when the settings window of the same account is opened, it becomes clear that the account is a demo. It is connected to the FxOpen demo server. It cannot be changed anymore. It is fixed and the option to change it is disabled. Of course, this is not visible to the public so it will look like a real account on Myfxbook.

It should, therefore, be noted that an account does not become real just because it has a real account status and its trading privileges are verified.

A couple of days later Myfxbook fixes this problem and continues to show the account as DEMO to the public. But even when it was fixed the question remains how many other demo MT4 accounts on Myfxbook are displayed as real accounts? Can we trust Myfxbook after this?

Is Myfxbook information private or public?

Another crucial thing to consider is if the information is private or accessible to the public. Myfxbook accounts with private non-accessible information should be avoided at all cost.

The only information that can be set to private is that of open orders. This is because open orders may be pending orders that are yet to be triggered. And since they are designed in a way that they can be triggered after several hours or even days, chances of being copied is very high if they are left open for public viewing.

However, when other information such as open trades, history, and commissions are hidden, then there are serious underlying issues with the strategy.

The issue of private non-accessible information is perfectly highlighted by this account:

A lot of information has been hidden: the balance, equity, lots, profits and so forth. What is shown is a huge, impossible gain of more than 53,000%, with a monthly average of 1200% in profit gains. This is beyond the apex of absurdity and only a crazy person would fall for that.

Even if a tiny detail is hidden while everything else is present, precaution should always be adhered to.

The creators of this other strategy below thought they were very bright:

Most of the information is present except history and lot sizes. Since the lot size is set to private, it can only be concluded that the creators of the strategy may have used tricks to come up with strategy.

A common method that tricksters use is the martingale trading strategy. It involves taking a risk with a huge trading size, which covers all the expenses and losses over a period of time – that is, if it succeeds.

However, for martingale trading strategy to be effective large lot sizes have to be used. The problem is most people do not like large lot sizes and are basically put off by them. Therefore, people are more likely to look at such strategies once and ignore them completely, if they were to come across their history and lot sizes.

Look at the difference between gains and absolute gains

Lastly, it is important to look at the difference between gains and absolute gains as these two parameters tend to be confusing to most people and may, therefore, be used as a frontier to trick traders.

Take a look at this legit example below which illustrates the “Abs Gain” very well:

After depositing $100, the strategy was able to realize approximately 103% gains. This amounted to around $109 in profit. But, after $100 more are deposited into the account, the gains remained at 103% while the absolute gains dropped to 59%.

The reason is that absolute gains recalculated the gains using the new deposit of $200. So, the main difference between the two is that: Gains show the growth from initial deposits, while Absolute Gains show the growth from current and subsequent deposits. This is completely normal and legit action, however, it might be used by scammers to fool people.

Scammers might grow a small account by 1000% and then deposit extra $10,000 USD to make it look like all the profits were gained on a big trading account.

Conclusion

In conclusion, tricksters are always looking for new ways of tricking traders. One of the various methods they use is the creation of fake myfxbook accounts to convince people into buying their strategies. There are various ways of knowing if a myfxbook account is a fake. First, check if the screenshot of the myfxbook portfolio is clickable or not. Secondly, check if the account has not been updated for a long time. Another serious thing to consider is if the account has been updated, but the last trade ended months ago. Thirdly, check if the track record and trading privileges are verified. Furthermore, if the account has a lot of private information, such as balance, profit, equity, open trades, lots and history then it is a fake. Lastly, if gain and absolute gains do not match it could signal fake results.

4 replies to "How to Know if Myfxbook Account is a Fake"

Thnk u very mch Rimantas for dis clear reveals of Myfxbook hidden thngs,u really doin a gud job sir mch appreciation to u.

Thanks 😉

Excellent material! Keep it up!!!

Thanks