There are dozens and dozens of forex news releases that happen each and every week. Most of the releases will not move the market very much, but some can move a currency pair’s price by more than 150 pips in just an hour’s time. Sometimes these moves can even take place in just a few minutes’ time.

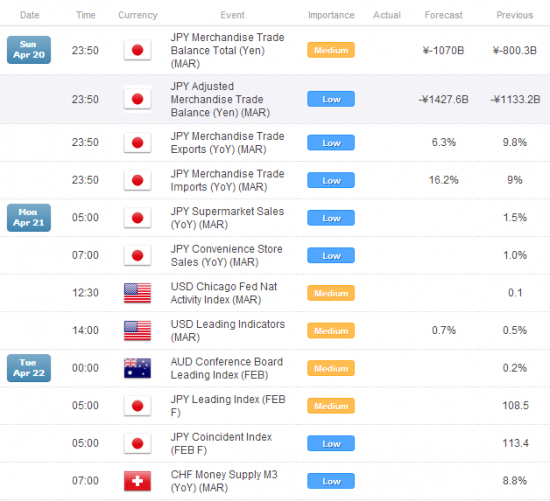

Here is a glimpse of a few of the starting news releases for the coming week. This represents rather light activity compared to later in the week. This first image is from DailyFX.com, one of the most trusted sources for forex news release information. You can use news sites like this one to help alert you to coming news releases. Many trading systems will advise people not to trade during major news releases because of the high volatility that is usually present during strong news events.

What types of news releases can be traded successfully?

Typically, only the higher impact news releases will move the markets with any kind of momentum. There are low, medium and high impact type news releases. The low impact and the medium impact news releases will usually not move the markets much (if even at all). But the high impact releases can really do some damage to an account if traded improperly. Below is an image of only the high-impact releases from ForexFactory.com, another of the highly trusted forex news publishing sources.

Correlation between related pairs during news events

If you are trading a news event with pending straddle orders then you can increase your potential profits by trading additional, related pairs. Let me visually show you this example here of a British news release. All of these following charts are displaying the 1-minute time frame with candlestick bars.

These 1-minute charts are often helpful when looking at news events because they show how price develops before, during and after the news release. For events that are public speeches or press releases where an important country leader is speaking, you can often see price jump all over the place, depending on what is being said at any given moment. The more predictable of the news releases are those that involve a specific number, like an unemployment rate for example.

This first pair is the GBPAUD and you can see how it responds to this high impact news release from the UK.

As you can see, the GBPCAD pair looks almost identical. Now, what if you were placing pending buy stop straddle orders just 15-20 pips outside of the closing price of the bar just before the news event? You might stand to make some profit with such a strategy.

In this case, had you placed these pending buy stop and sell stop orders with a 15-20 pip range straddle around the closing price of the candle before the news event then you would have been taken into a buy trade on the news release candle. Your sell stop would have never triggered or been filled. You would have had a nice profit on the large upside move.

Here is the GBPJPY on the same time window of the GBP news release which came out at 8:30am GMT. The move is nearly identical to the previous one because of the Pound as the base currency.

Likewise here with the GBPUSD pair, the move looks almost identical to the previous charts. If one breakout strategy were to work then they would all work because of the near-identical moves on all these pairs.

This pair, the EURGBP, we can say is negatively-correlated with the above pairs because in this case the EURO is the base currency and not the POUND. But regardless, the move is almost identical, just in opposite direction of the other pairs shown here. It is not as ‘tradeable’ because of the rather similar prices of the euro and pound currency pairs. It meant that this move on the EURGBP was only about 15 pips total as compared to more than 30-40 pips of the other pairs like the GBPAUD and GBPJPY.

If you have interest in trading the news, I have two ideas here for you based on two different software solutions. The first is called Candle Range Trader and it is used for trading breakouts based on certain ranges. Another software that can help a forex trader trade the news is called the Range Box Trader. Both of these pieces of software are designed to help capitalize on what is typically referred to as breakout trading.

What is breakout trading?

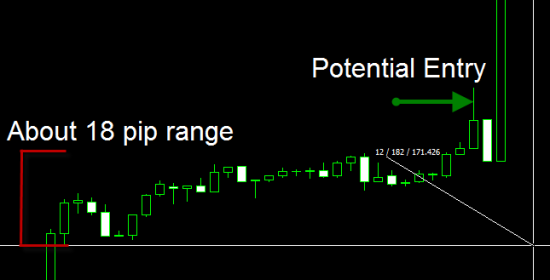

Breakout trading is all about waiting and pouncing. Let’s look at this illustration below where you can observe a range as marked out by the red lines on the left of the chart. This is a range that is leading up to the news release on the GBP. This price consolidation can be a potential good setup for a range breakout trade.

As you can see, there is a range on the chart. These are 1-minute charts, the same as what we were looking at above. The range on the chart, depending on how you would mark it, would be around 18-20 pips. This is typically what happens before big news releases. The markets will often calm themselves down and settle into tight little ranges like this.

This is one way to trade breakouts and to trade the news as well. You start by identifying a range and then position yourself to trade breakouts of the range. You can use a Buy Stop order and a Sell Stop order to straddle the current market price, anticipating a breakout.

At this point you are just waiting for your trades to be triggered. If the breakout is strong and in only one direction then only one of your orders will be opened, as you can see with this scenario. You could even use hidden pending orders with the help of this trading tool on MT4 platform. The beauty of this is that you can set hidden pending orders to risk % percentage per trade based on the available account equity at the time when an order is being triggered. You can’t do this with regular pending orders.

As the news release comes out, or in this case a couple of candles before, the Buy Stop order was triggered and then if you simply closed your trade at the close of the ‘news candle’ then it would have meant about 33 pips in profit. And if you had of traded this same strategy on multiple pairs then you might have been able to net over 100 pips in profit for one high-impact news event.

Again, this is just one method for trading the news and for trading range breakouts.

Do you have any other ideas that you might like to share?

Please put your questions, comments and ideas in below and let me know what you think about this trading idea.

2 replies to "Is it Possible to Trade the Economic News Events Successfully Using Range Breakouts?"

What I find interesting about breakouts is spotting the small opposite move, prior to the breakout, this is the only entry I am interested in in relation to breakouts as it still gives room to get out with a small profit. I haven’t found many reliable pieces of data provided to retail traders that can pin point this small opposite move, but am still working on it. Personally I can pick it but cannot afford the luxury to sit in front of the screen for each one.

The actual breakout move is mostly untradeable as the banks will not fill orders in the ‘large bar’ range, so effectively the large bar move is a ‘gap’.

I was seriously looking at your breakout EA at one stage as it looks quite good, but what puts me off these types of trades is often these are deliberate ‘fakeouts’, when they do run orders aren’t filled at ideal prices.

Conway, thanks for sharing your ideas. Your small opposite move sounds like a bulge/squeeze that John Bollinger uses. Been attending one of his lessons recently.

In the future I will see how can I improve my breakout EA, but for now I agree that it can get involved into false breakouts pretty easily. So as always, human intervention is highly recommended when trading these types of breakout strategies using my EA.

Some of my customers set the EA every morning they believe there is an opportunity and they set which direction EA is allowed to trade to lower the false breakout trap.