The statistics tell us that most traders fail. If you read a lot of the material online then this is what you are going to hear from other currency traders. And if you look through a lot of the trading networks, like MyFXBook.com or ZuluTrade.com, and you start to look at a lot of portfolios from those types of sites, you’ll notice that most people do not trade consistently profitably. Currency trading is probably one of the easiest businesses in the world to get into. You can begin trying it out for free and can even begin trading with most brokers for as little as $100. But in my estimation it is probably one of the hardest businesses in the world to succeed in and do well consistently over the long term.

I’ve identified six things that many traders struggle with. These are not all of the things that they struggle with, but it is a starting list of items that you might be able to identify with, and by working on, you can change for the better in your own trading business.

1. Choosing a trading system

It really depends on how long you have been trading (or trying to trade) the forex market as to how many trading systems you might have tried. Most novice forex traders will jump through a large number of different systems before finally settling on the right one for them. Sometimes unsuccessful traders will continue to jump from system to system for literally years and not ever get anywhere. It is a very common problem that a lot of traders face. Some may even try a number of systems and then quit out of frustration, but I hope that is not you.

There are so many reasons why a trading system may not work. Many trading systems that have been created in the last 10 years are simply not that good. And in a lot of cases you pay for what you get. There are some financial, investing, and trading courses the cost upwards of $25,000.00 but many of them cost of $1,000 or less. Some are even free and others cost $99. Regardless of the price, many of these systems are simply not very good.

Many of the courses available to traders are put together by marketers who are looking to earn money by selling an information product. They put up fancy web pages and make big, lavish promises. Many times the courses are not very good but it is hard for amateur traders to tell what is what from a fancy sales page. It is so easy to sell the allure of making a lot of money! This is where a lot of Forex traders are duped into believing that they can get rich overnight and that trading Forex can be made simple and easy.

Simple and easy are two words that should never be used to describe trading the foreign exchange markets. The Forex markets, by their very nature, are unpredictable and very difficult to trade profitably. Usually those traders who succeed have been trading for many years and are skilled, not only by the courses they have taken, but even more so by to the experience they have gained by trading themselves. This real world experience can never be taught through a course. It can only be learned through months and years of trial and error.

2. Sticking with the same system/not jumping from system to system

A trading system will often not work fundamentally. It may be founded on false principles or it might have been conceived by someone who has little concept of how the currency markets flow. But how do you know that the system is flawed when you purchase it or read about it? When you start to implement the system and it doesn’t work, how do you know it is the system that is bad and not your execution of the system? How do you know that a string of losses is simply a poor time in the market rather than a poorly designed trading system?

For inexperienced traders it is almost impossible to be able to tell between losing trades and a losing system. So newbie traders get stuck and assume that because they are losing so much that the system must be bad. Many times this is the case, but not always. There are good systems, but even good systems can lose a lot and yet still be profitable. There are even winning systems that work at certain times of the day and not others.

So when you have a trading system that does not perform well for a couple of weeks of even months know that it might be just a bad time for it. Maybe it will work for the rest of the year. Imagine if you test a losing system for 2 months, quit, and then a year later you realize that the rest 10 months were all winners.

In Autotrading Academy we teach to test automated trading strategies (a.k.a. Expert Advisors) for at least 6 months before deciding if it’s worth any good or not.

3. Controlling emotions and following the rules of the trading system

Emotional control is one of the marks of the truly great trader. Great traders must be able to calm their emotions and not boil over at the first sign of trouble. When losses happen, which they do, even to the best of traders, you must be careful to not flip-out emotionally. New traders especially struggle with this issue. Sometimes when the new trader begins trading and they experience a loss or several losses in a row they can even break down in tears or start cursing at the computer and say how they will never trade Forex again. This is understandable to be upset, but it is a very amateur approach. Instead, continuously read material that will help you gain emotional control.

Those to become very skilled traders are the ones who spend years doing it and mastering their emotions all along the way. It will naturally happen if you spend years in this business. You will naturally become more callous to the losses and they will not affect you as much. You do not want to be on a roller-coaster of emotion in your trading business. Even when you win, do not get too excited. It is better to stay in the middle range of emotions rather than experiencing the high highs and the low lows.

My personal experience in dealing with Forex trading emotions was that I read a lot of books on personal development. Even now I occasionally read motivational material that helps me to improve myself. This is useful not only in Forex business, but in everyday life as well. Invest time and money in personal development and in 6 months you will start to see huge changes in yourself. This is how you grow and your business grows with you.

4. Staying encouraged in the face of losses

This point more relates to your long-term approach to trading. When you experience losses and drawdowns and losing months in your trading business, what will you do? Will you pack up the tent and head home or will you persist? The best traders in the world will continue on trading even after they have a losing YEAR. Certainly they may take time to evaluate why they had some losing months (maybe it was just the market reversing, for example) and see what they can do better in the months ahead. But they will not let it get them down.

The experienced trader will not take a losing month and turn it into a losing year if they can help it. But if this happens they will not let it get them down. Professional athletes experience the same kinds of problems. Every athlete at some point or another has gone into a slump. The world famous tennis player, Andre Agassi, experienced a severe slump. He just couldn’t do well for while and he did not have the confidence to face his very tough opponents. He did not have that winners edge for a while.

So what did he do to get over his slump? In Agassi’s case he hired a professional coach and trainer to help him work on his psychology. After some work and training he regained his edge and became competitive again in the world of tennis, going on to win several world titles.

Likewise, professional baseball players can often get into batting slumps. They may have been doing brilliantly before, but sometimes as humans we just get jarred a little and we lose our edge.

Professional baseball players cannot take a month off when they have a bad hitting streak. They simply have to keep going into the batting cage, game after game, and continue to try and hit the ball. This is the best way to get through a slump. You don’t take time off and go sit in a corner. You keep doing what you should be doing as a trader—which is trading. This does not mean, of course, to trade recklessly or just take trades for the sake of taking trades, but it does mean you keep doing what you’re getting paid to do. And you must think of yourself as a professional trader. Your job is to trade. Keep doing your job into you get your edge back. Become a professional and realize that everyone loses at some time or another. The winners are the ones who take the losses and keep going, getting better day by day by day.

5. Trading at the right time of the day and week

This is most often overlooked by new traders. Different times of the day produce different results. They think that because the Forex market is open 24 hours a day, 5 days a week, that it can be traded 24 hours a day and 5 days a week. If you have been a trader for more than a year than you have probably realized by now that this is simply is not true. Sometimes the market is more responsive than others and sometimes the market ebbs and flows better than at other times. During the Asian session, for example, the average range on the EURUSD pair can be rather narrow, but is often more profitable than during the more active sessions according to this article on the EURUSD as reported by DailyFX summing up analysis by trader David Rodriguez.

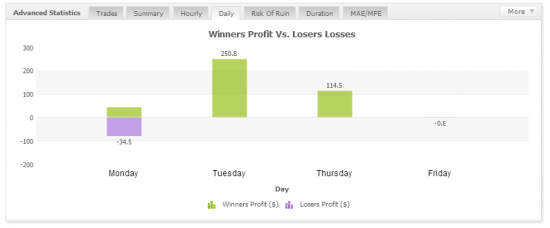

Here is an example of the different kinds of profitability that can be found on a winning trading system according to the days of the week. If this trading were to continue on in such a way then it would be advisable to perhaps not trade on Mondays. This data is a little ‘slim’ because it has not been evaluated for months at a time, but it surely is a good starting point.

6. Managing fear and greed while trading

There is no fear when we are trading on a demo account. And why should there be? When you have no skin in the game then it is easy to have a cavalier attitude towards the trading. You could even think about trading as some sort of video game or computer game. A trading platform, after all, will have a number of bright colors and patterns that can be pushed just like a video game would have. It makes noise and things move all about, also much like a video game. Trading can be very exciting as well—it is easy to open up a demo account that has $100,000 in it, place a single trade and make more than $5000 in that one trade (if it happens to go right for you.)

This is often how amateur traders get hooked. They think, “Oh wow, I just made 5% on my money by just pushing a button and it only took two hours to do it!” It is the potential for gain that draws many traders to Forex in the first place. We hear stories of traders making more than 100% per year on their money and we get interested. Everyone wants to be a superstar Forex trader, but very few will actually achieve this feat.

It is unrealistic for most people to earn 100% or more on their money each year, consistently. And perhaps consistently is the best word to use. Consistency in trading is a very difficult thing, perhaps the most difficult thing for some traders. Having a great month is wonderful, but many of us know that a great month can often times be followed up by a bad month. The less experienced traders will become fearful about trading in the future if they experienced this kind of patter. They will become gun shy and not want to place too many more trades because losing brings pain.

As humans, most of us do not like to experience pain in any form. We do whatever we can to avoid pain. Trading can certainly bring pain. One of the things that many failing traders do is to let the fear of failure get in the way of succeeding in the future. It is understandable, but you must not let this fear prevent you from taking action and getting better in the future.

Yes, you do not necessarily have to trade on a live account, but to get over your fear of losing real money, you will have to use a live trading account at some point. Hopefully it will be a small live trading account and you won’t blow your money simply gaining experience. If you are going to lose money to gain experience, make sure it is a small amount of money rather than a larger amount.

So what are you going to do about it?

I hope these ideas will give you some thought on how you might be able to improve your trading business. There is so much to work on as professional traders. We must always be sharpening our axes and continuing to get better at every opportunity. There is no room for laziness or complacency in the world of a professional trader. A professional trader is always improving something if they can. A professional trader is always taking action in a positive direction to try and earn money in their trading account—never really content with the performance of the day before because they know they can always do better.

Do your best to not let emotions like greed and fear get involved in your trading decisions. You must function like a robot in many ways, but with the intuition to adapt to the market as a human. Please take what I shared with you here and apply it to your business! Write down a list of the things that you need to take action on to implement these ideas. Imagine yourself as a professional athlete. Do you need a coach? Do you need someone who is accountable and who is keeping you focused and in the right direction? Maybe you should hire a Forex coach…

Bear in mind that there are several things that you could do in the month ahead to improve your Forex trading business. I really encourage you to write down this list and work out an action plan on how you’re going to work on them, step by step, until you are a better trader.

Please share your results and share your ideas on how we can be better as traders in the comment section below.

4 replies to "6 Hardest But Very Important Decisions for Currency Traders"

Haha.

Wonder why you write this post? No seriously why? But it is true majority of solid system in the market are not profitable in the future. Only in the past. I used to admire with respect to those traders who blog about trading and having trading products to sell. Many of which you would know like…

Ed Ponsi, Al Brooks, Peter Bain, Nial Fuller, Rob Booker and Lance Beggs. After which all are good teachers. Those trainers at dailyfx, Wayne mcdonell and Kathy liens. Now I don’t trust them anymore.

Even those with screenshots of their weekly if not daily trades. As I understand if they blank their trading account number or their trading reference. They have something to hide. Regardless of whatever reason you should have a transparent transaction for students to follow. The only trader I respect is Timothy Sykes and one of my local trainer.

In the light of this I love to teach what I know about trading Forex as I blog. I even manage to make 100% in 2013 and 80% in January 2014.

I’ve proof Google myfxbook newbietofx.

Despite of this I will not create nor sell any products because I’m not making a living trading Forex.

Most importantly I want to be transparent like Timothy Skyes and Rob Booker.

Carry on. I think you should have a transparent transaction report like Tim Skyes to validate your expertise to show social proof.

I found out. It is not how many pips you get per trade that gets ppl attention. Is how much in dollars you get per trade that gets you following. Even if u get 1pip. But that 1 pip is the 10 lots. You will get following.

Try it.

David

Dear David,

thanks you for your comment and opinion. Please find my comments below.

> Wonder why you write this post? No seriously why?

I just wanted to share with currency traders what I know about these 6 things that most of us find it difficult to deal with. Not everyone for sure, so if you did not understand what I was saying in this post you probably are perfect trader and never had trouble with any of these 6 things.

> As I understand if they blank their trading account number or their trading reference. They have something to hide.

Yes, many people have something to hide, so I hope I am not looking like one of them. Signal providers with “private” parts of their trading record, trading robot sellers with the backtests and no live trading proof, etc. It is so easy to spot who has the potential and who is just trying to sell a product that even himself does not believe in.

> The only trader I respect is Timothy Sykes and one of my local trainer.

Tim looks to be a great teacher, because he did this by himself. Well, when I will achieve something like this I might have similar offer too. At the moment I am a programmer and a trader who has only 6-8 hours 5 days a week to work on his projects, and believe me, I am doing more than I can chew.

> I even manage to make 100% in 2013 and 80% in January 2014.

Good for you. Hope you are getting the most out of this success.

> Despite of this I will not create nor sell any products because I’m not making a living trading Forex.

Well, if you were making a living trading Forex you would want to create a product. And I do not have in mind that just any product to just sell to people, I mean a real product that changes people lives and make things easier for them, solves their problems. This is what I am trying to do. I am definitely not trying to teach anyone make a million dollars in Forex, because I did not make it myself yet. But everything is possible.

Good luck with your trading and your blog.

Regards,

Rimantas Petrauskas

Hahaha, not meant to rude.

Just some interactive conversation.

No problem 😉 I understand.